Indexes are an essential while basic commodity of the asset management industry, as such they should be easily substitutable and affordable. FCI Indexes perfectly match this definition with high quality Indexes, substitutable on all criteria to current Equity Indexes and accessible at a fair price. What's more, they offer no usage restrictions and a commitment to increase fees no faster than inflation.

As a long-standing player in the financial industry, our clients regularly came to us with their concerns, claiming that they were poorly served by index providers, that fees were extremely high, with unpredictable increases every year, with complex licensing agreements, bundling practices and onerous restrictions on usage. The FCI indexes have been designed to meet all their concerns and offer high quality equity indices that are perfectly substitutable for all their needs.

Thanks to its unique Methodology FCI produces either Vanilla or Client-designed indexes to fit with the client’s requirements.

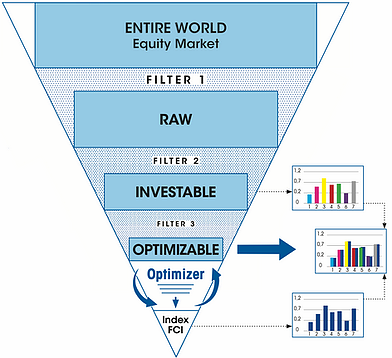

From the Entire Global Equity Market, FCI applies a first criteria to qualify/determine the Raw Market that the Index will represent with a small number of equities. Classically it is based on geography, sector or industry membership, but it can also be based on market capitalization size or any criteria for grouping a thematic universe.

This Raw Market is then filtered twice to define the Investable Market and the Optimizable Market, a final subset of equities considered relevant in terms of liquidity and R2 to be potentiel index constituants.

The Index is then derived from an optimization process using the APT optimizer to mimic the Investable Market with a predetermined number of equities, i.e. with an APT risk profile as close as possible to the Investable Market with the lowest ex ante Tracking Error.

This optimization process at the very core of FCI's methodology gives us an unrivalled agility and flexibility to integrate any type of constraint (exclusion, caps, …) or preference (ESG or Climate related for instance, …) when constructing FCI indexes.

FCI is a Benchmark Administrator approved in accordance with Article 34 of the Benchmark Regulation (Regulation (EU) 2016/1011 of June 8, 2016)

FCI is registered with the “Autorité des Marchés Financiers” (AMF) under number BMR2020000001.

FCI is listed in ESMA's register of Benchmarks Administrators.

When building an Index, the optimization process using the APT optimizer aims mimic a predefined Investable Market with a small number of constituents and no bias.

By this unique way of producing the index, we guarantee the strict neutrality of the index calculated and ensure an absence of conflicts of interest in the choice of constituents and their weightings - a key factor in the success of FCI Indexes.

FCI Fees essentially factor the size of the company’s assets under management, tempered by the number of indexes to be provided and their complexity (i.e. use of external data other than market data, exclusion rules, preferences, …).

Within the same group, we make no distinction between entities or locations, which can result in substantial savings.

Subscribing to an index allows you to use our data for any purpose, without restriction. We provide you with price data and constituents, which you are free to use for performance or risk allocation, reporting, communication or marketing, and other functions. This also includes the use by your administrators and custodians.

FCI indexes are effectively substitutable for current equity indexes on all criteria, whether in terms of geography, sector, style, performance or delivery.

We offer a “like-for-like” alternative that lets you decide at any time to replace a current equity index with an equivalent FCI index and implement it smoothly.

Beyond classical offer, FCI proposes Client-designed indexes constructed to meet your specific needs.

Thanks to FCI's unique index building process, customer-designed indices are available at an affordable cost close to vanilla index prices. This offers great advantages, both in terms of structuring investment processes for asset management companies, and in terms of transparent communication with investors.

Our DNA is solution-oriented, and we'll be delighted to answer any questions you may have, working alongside you to support your thinking and development.

Confirm interest and perform preliminary tests on selected FCI indexes or ask us to carry out preliminary custom work on the index you're interested in

Install FCI indexes internally => POC

Validate FCI indexes as a sound alternative => Parallel run

Switch to FCI Indexes

| Data Vendor | FCI Avaibility | Valuations | Compositions | Performance Attribution |

|---|---|---|---|---|

| Amundi / Alto | ✓ | ✓ | ✓ | |

| MarketMap | ✓ | ✓ | ✓ | |

| Bloomberg | ✓ | ✓ | ✓ | |

| FactSet | ✓ | ✓ | ✓ | ✓ |

| Refinitiv | ✓ | ✓ | ongoing setup | |

| RIMES | ✓ | ✓ | ✓ | ✓ |

| INFIN | ✓ | ✓ | ✓ | |

| LAKANT | ✓ | ✓ | ✓ | |

| FUNDCLASS | ✓ | ✓ | ||

| SIX | ✓ | ✓ |

The choice of a benchmark provider is an important decision. It is an opportunity to express a responsible choice that is incumbent on all industry players, first and foremost asset owners.

FCI Indexes provides you with a comprehensive framework of Benchmarks covering the global stock market segments.

FCI offers a suitable like-for-like alternative to existent Indexes with high quality Indexes at a controlled Cost.

FCI indexes are effectively substitutable on all criteria from geographies and sectors to style, performance and delivery to other indices.

FCI is registered with ESMA as an index Administrator and regulated as a Company under Benchmark European Directive and certified by AMF. and therefore guaranteeing the quality, integrity and traceability of its Indexes.

FCI is a European player, while choosing FCI, you are recovering data sovereignty and contributing to the development of the European Financial Industry.

Because asset management is a fiduciary profession, it is founded on trust and transparency between all parties involved.

Choosing an index is an important step in structuring an investment process. The index must represent, as closely as possible (without bias), the performance of the country, market segment or theme of your investment fund.

The index therefore enables the management company to assess management bets in relation to the index, and their impact on performance and the risk taken by the manager. The index is also key, on the passive side, for reporting to investors (performance and risk attribution).

FCI indices are the ideal backbone for all types of management, whether active or passive. Whatever the investment universe, whatever the market segment, With a limited number of stocks (tradability), they offer the highest systematic correlation with the investment universe (representativness), and the lowest tracking error relative to the investment universe, all without bias.

Because FCI index construction methodology is systematic, it makes it possible to integrate all types of constraints and preferences, as long as these constraints and preferences are systematic and/or can be expressed in the form of rules.

This series of indices, called FCI client-designed Indexes, because it is designed by our customers are thus as close as possible to their objectives, whether to reflect an investment theme or to take account of dispersion, exclusion or other constraints, And/or preferences.

Please access here our comprehensive list of FCI indexes and factsheets.

Contact us, we'll be pleased answer your needs!

Please note that it takes roughly 1 month to put a new index into production, depending on its complexity. Please contact us.

We'll be delighted to provide you with more information, with no obligation on your part. We call this stage Proof of Concept. It allows you validate your choice of FCI indexes before contracting with us. Please contact us.

Please contact us to validate your precise requirements (relevant Index, prices, constituents, etc.) technical and financial conditions that will enable us draft a contract proposal.

Please call for a demo, we normally deliver you the data immediately after a commercial contract has been signed.

We propose to set up a parallel run contract. The aim of this contract is to enable you on ta specific period to familiarize yourself and your environment with the use of a FCI index. This period is designed to enable you to settle all the issues involved in switching indexes - technical, regulatory, commercial, etc. At the end of the parallel run period you will have in your hands all the information you need to decide whether or not to make the switch. Please call us, we'll be happy to answer your questions.

Parallel Run usually corresponds to the renewal date of your contract with your current index provider. It could last up to 1 and a half year if necessary. Please call us for a more precise answer.

Parallel Run is offered at a symbolic price as you already pay an index provider. Please call us for a more precise answer.

Data could be delivered either via flat files in FTP mode AND/OR via one or more delivery platform from among those with which we already have links. Please call us, we'll be delighted to answer any question

Here is the current list of delivery Platforms authorized:

Please call us to get more information on accessibility, Index codes, … for each distributor.

We work with the distribution platforms on a permissioning basis. Ask the platform of which you are a client to access our indexes. That platform will ask us for permission to open the feed to you. As soon as we give them the go-ahead, the feed will be opened. Please call us for a specific answer.

At your request, we will contact the platform in question to set up a distribution contract with permissioning. Please call us for a more precise answer.

Technical questions are usually quickly addressed on our side as are contractual matters. However, we cannot guarantee the speed of response from the Platform of your choice. Please call us for a more precise answer.